Notes on the financial position

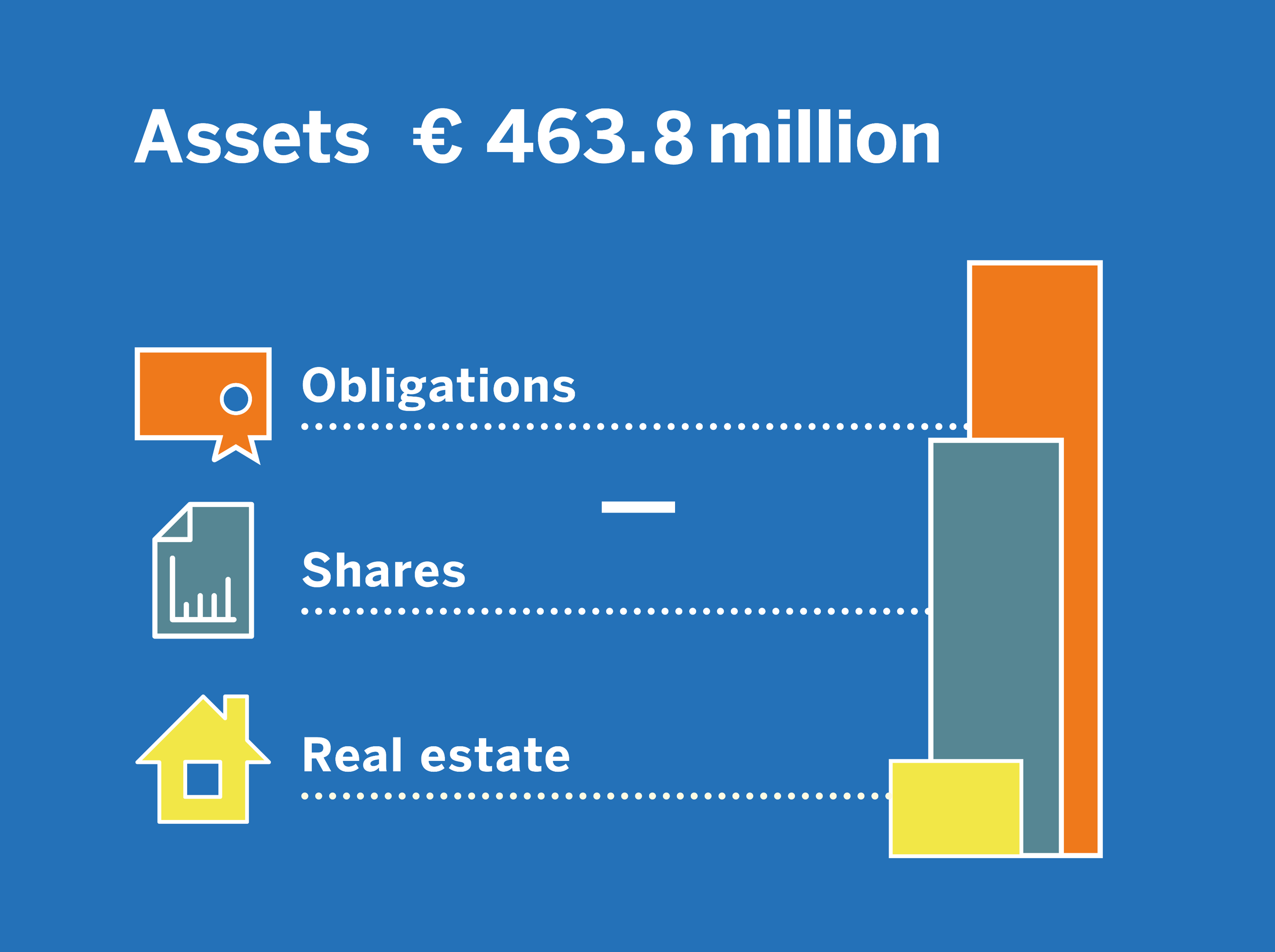

- Assets: our assets stood € 463.8 million.

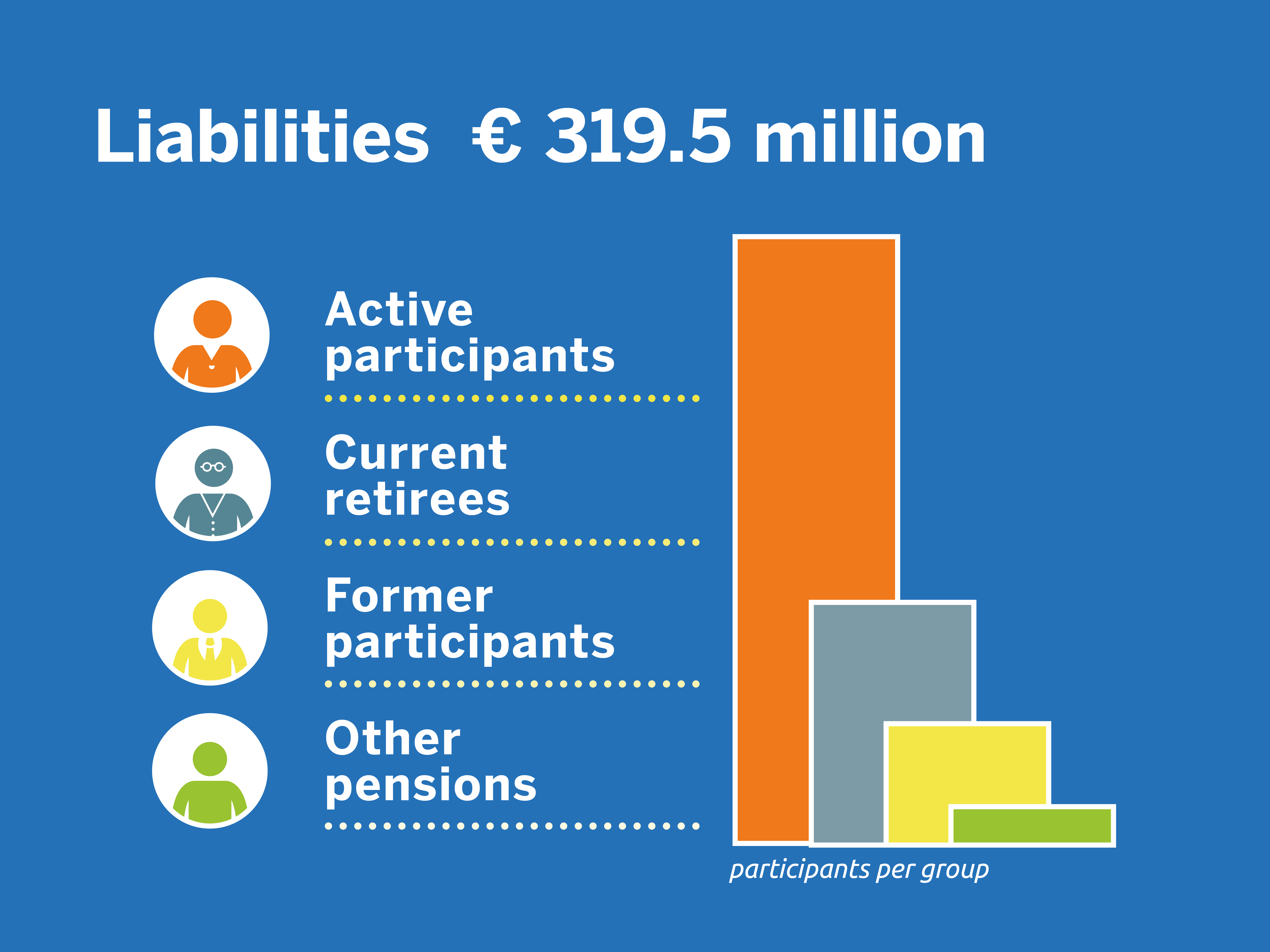

- Liabilities: the money we need to be able to pay all pensions (both now and in the future) is € 319.5 million.

- Nominal funding ratio: The funding ratio is the ratio between the assets and the liabilities. The nominal funding ratio is 145.1%.

- Policy funding ratio: The policy funding ratio is the average funding ratio over the past twelve months. The policy funding ratio is 136.5%.

Obligation to build additional buffer

If the assets are equal to the liabilities, so if there is exactly enough money to pay both present and future pensions, the funding ratio is 100%. This seems to be sufficient, but this is not entirely true. The future is uncertain, so it is important for pension funds to have a secure buffer; in that way we ensure that we can pay out all pensions, even in case of a financial set back. The size of the buffer follows governmental regulations and may vary according to the risk level of investments and the current interest rates.

How large should the buffer be?

According to the rules set by the government, our assets must exceed our liabilities by 16.3% (August 2025). This means that we have sufficient assets to pay out pensions, both now and in the future, plus a buffer of 16.3%. This also implies that we can manage any unexpected decline in our assets. Currently, the policy coverage ratio of 136.5% (end of August 2025) is above the required coverage ratio. Therefore, the pension fund currently has sufficient financial buffers.

Recovery plan

The pension fund has not had a reserve deficit since the third quarter of 2021.